We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warnings for MaxiInterest Investment Deposit.

Eligible customers who successfully subscribe MaxiInterest Investment Deposit online with as low as HKD5,000 can enjoy extra 2% p.a. interest rate for one month. Read Forex investment guide

A MaxiInterest Investment Deposit is a currency-linked structured product involving derivatives, with an opportunity to earn potential interest returns, or to exchange the linked currency at a predefined rate, at maturity. Minimum online investment amount of HKD5,000 only and you may capture FX trends and earn potential interest return.

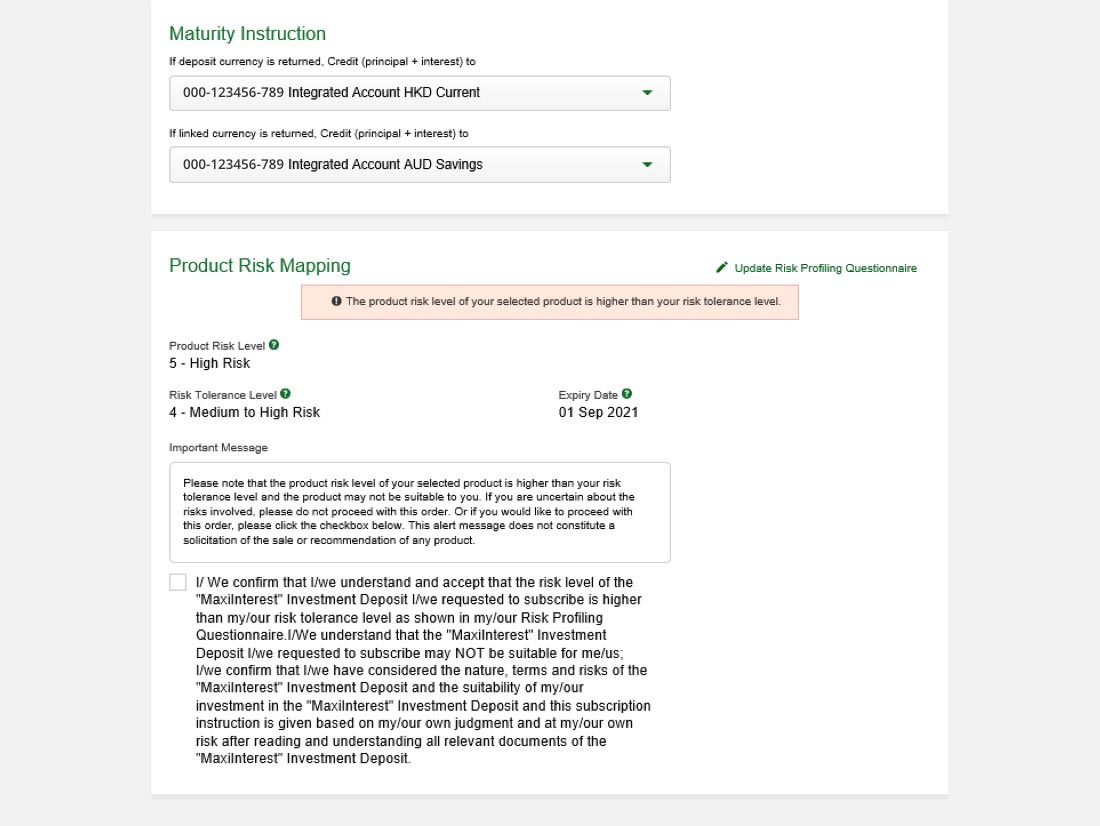

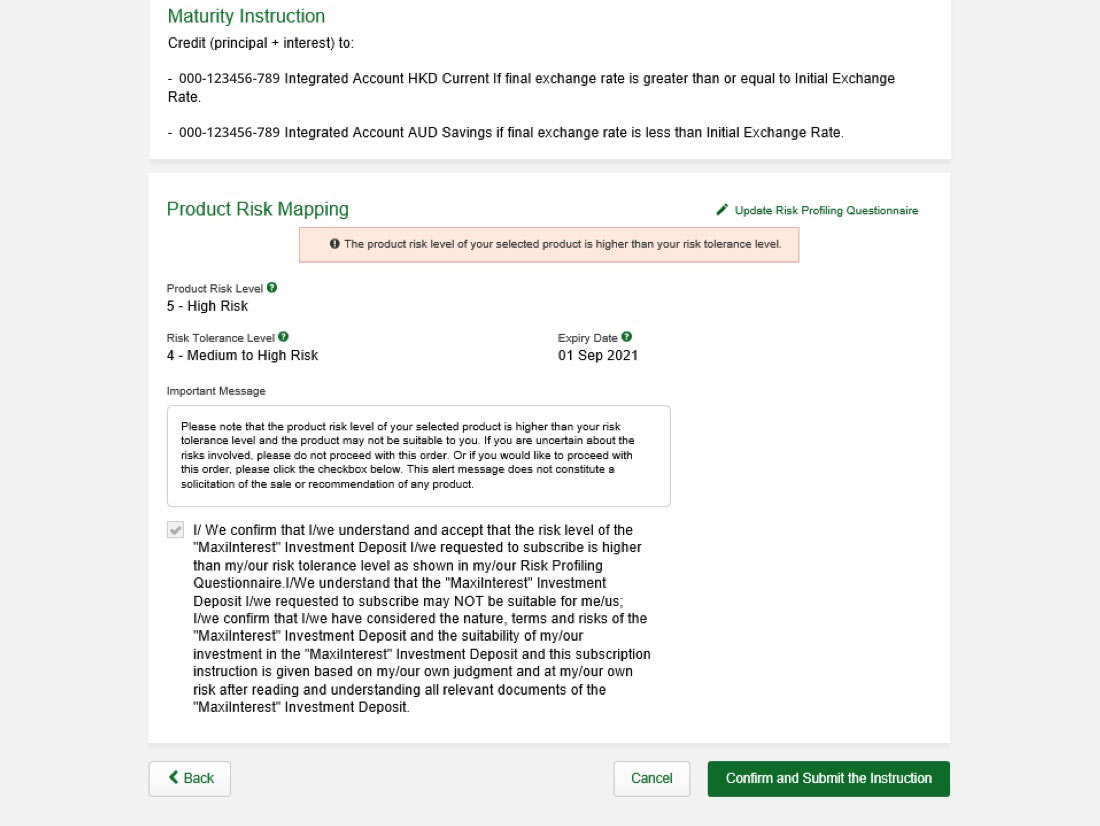

What is Risk Tolerance Level?

Potentially higher interest return than normal time deposits with favoured market price movement

You may also exchange receive the linked currency at a predefined rate[2]

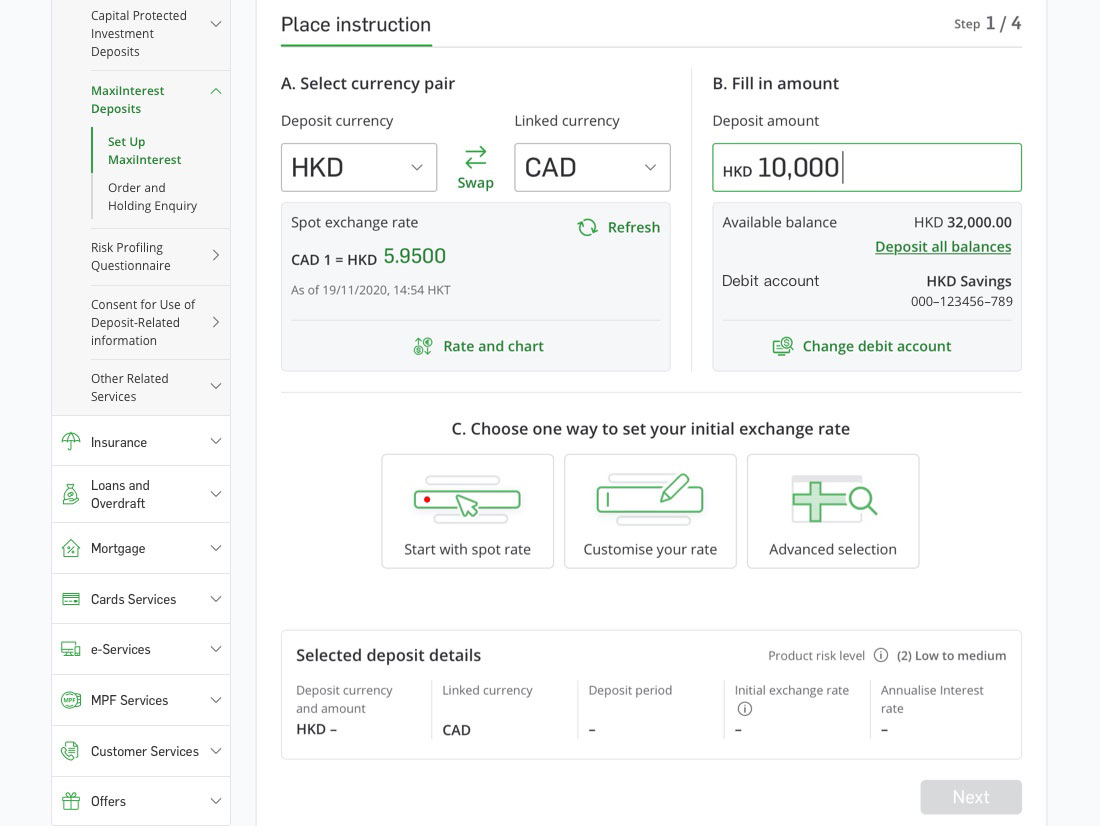

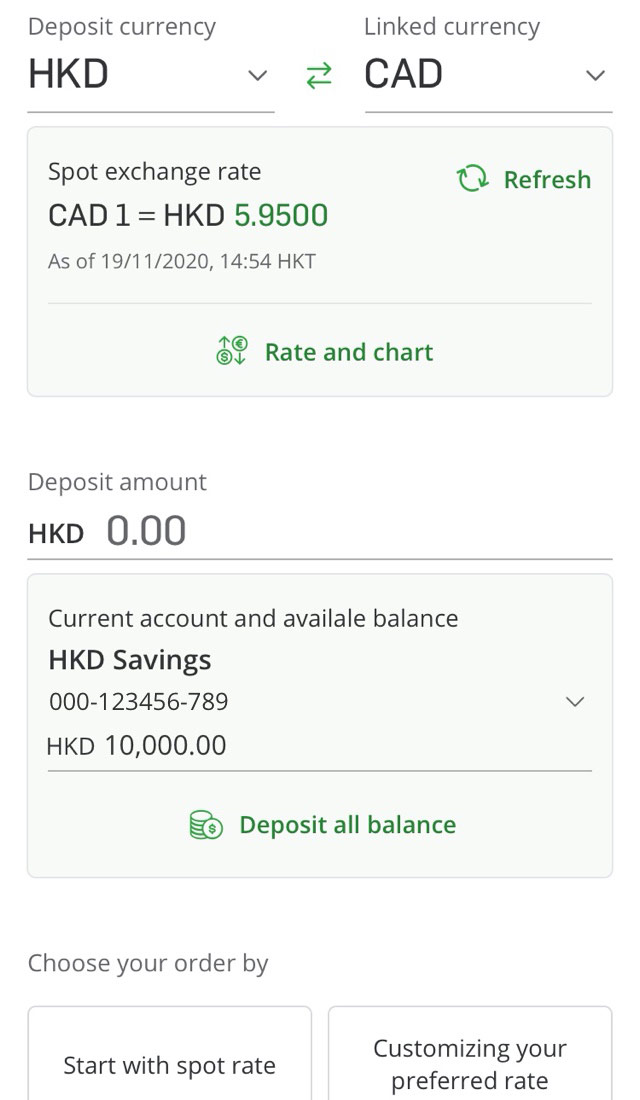

Investor can choose the deposit currency and linked currency according to your needs.

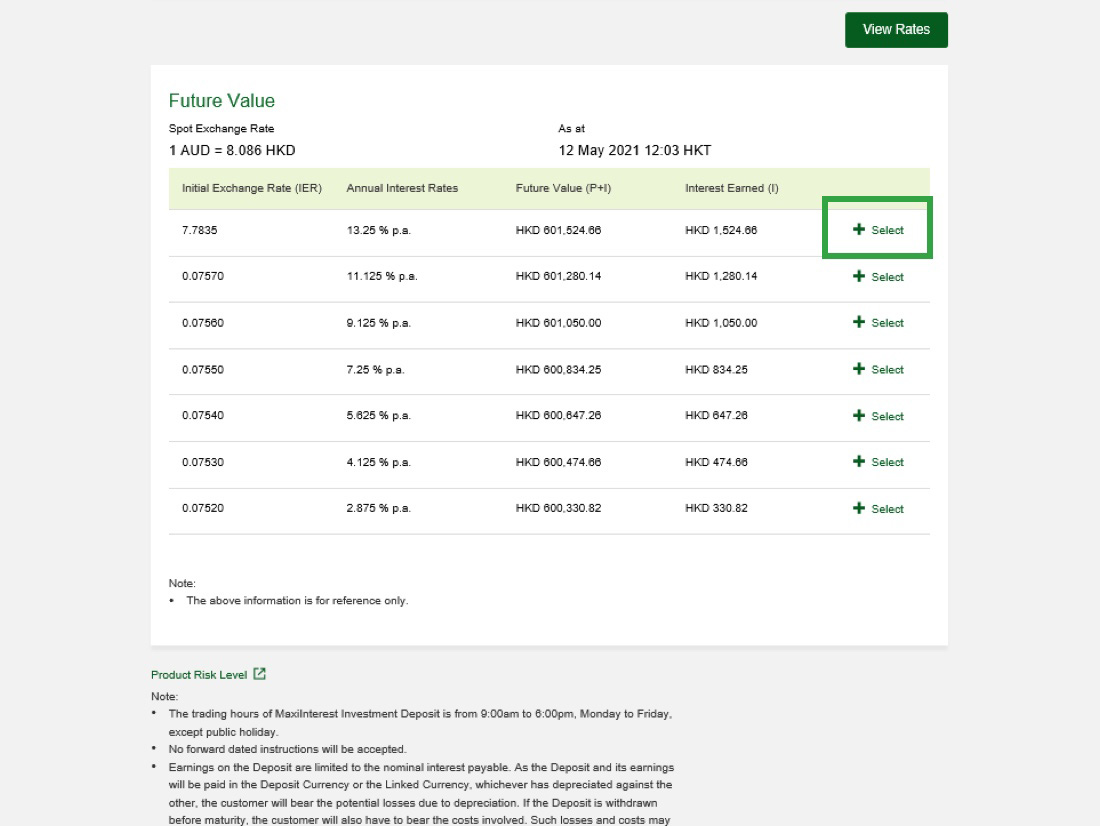

Then, you can set the initial exchange rate according to your interest[4].

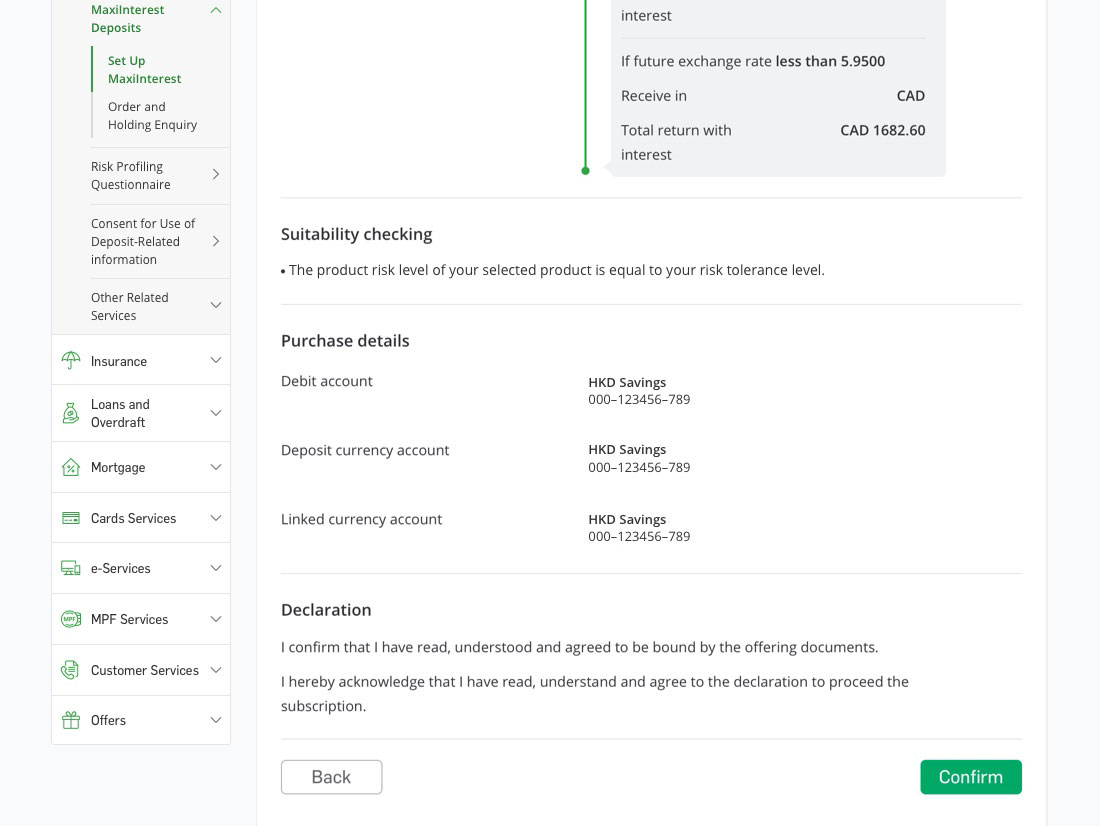

Compare initial and final exchange rate as determine by the bank on the final exchange rate Fixing date[5] to determine the total amount you can receive at maturity.

| Scenario | Amount (Currency to be received) |

|---|---|

| Linked currency appreciates relative to deposit currency or remains unchanged | Principal + Interest (paid in deposit currency) |

| Linked currency depreciates relative to deposit currency | Principal + Interest (converted to and paid in the linked currency at the initial exchange rate) |

Assuming Hong Kong Dollars is your home currency.

Now, you take a bullish view on Australian Dollar, so that you expect the exchange rate of AUD / HKD to increase (AUD appreciates relative to HKD).

Terms

Units

Deposit currency

HKD (Home currency)

Linked currency

AUD

Principal amount

HKD100,000

Deposit period

1 month (30 days)

Initial exchange rate (AUD / HKD)

6.8400

Annual interest rate

4.000%

AUD / HKD on final exchange rate fixing date is equal to or higher than 6.8400

Final exchange rate: 6.9000

When you subscribe

You invest HKD100,000

On maturity date

Received currency and amount upon maturity date HKD100,328.77

Your gain upon maturity date

(HKD100,000 x 1 + 4.000% (Annual interest rate) x 30/365) - HKD100,000 = HKD328.77

AUD / HKD on final exchange rate fixing date is lower than 6.8400

Final exchange rate: 6.8000

When you subscribe

You invest HKD100,000

On maturity date

Received currency and amount upon maturity date AUD14,667.95 (principal plus interest paid in AUD by exchange rate of 6.8400)

Your loss upon maturity date

{[(HKD100,000 x 1 + 4.000% (Annual interest rate) x 30/365) / 6.8400] x 6.8} - HKD100,000 = HKD257.95

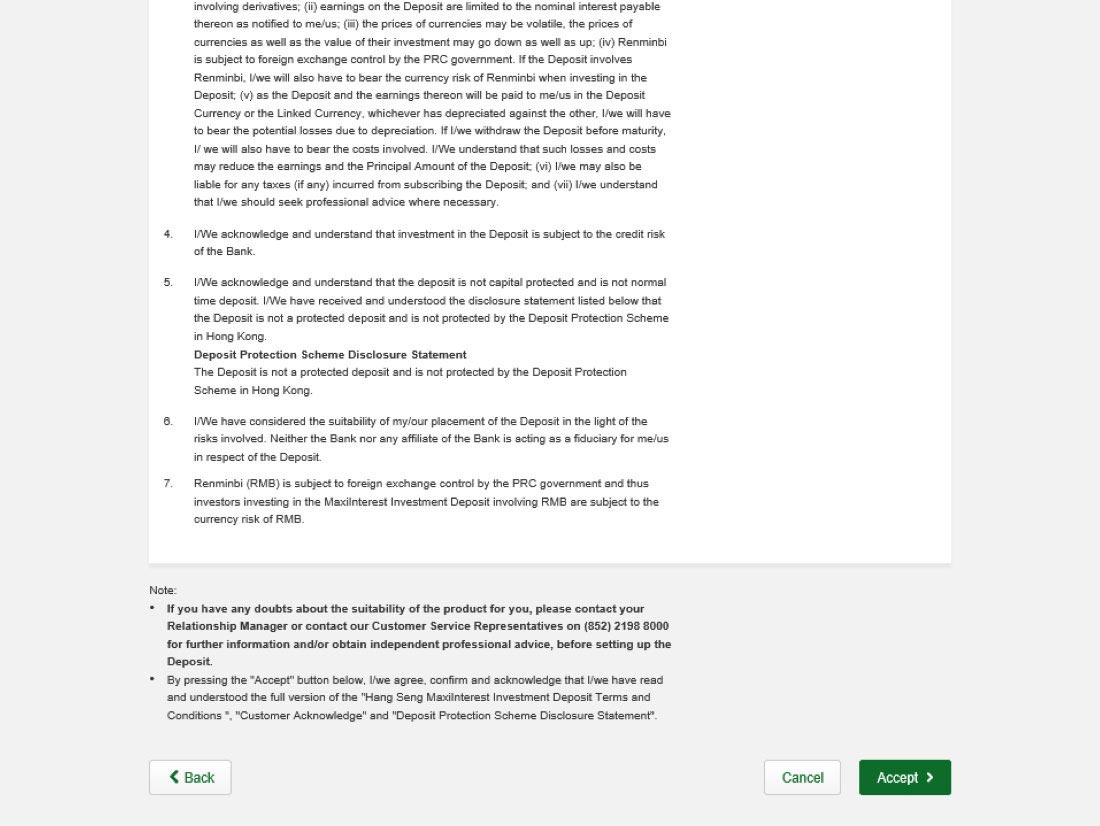

Assuming that the Bank becomes insolvent during the tenor of this product or defaults on its obligations under this product, you can only claim as its unsecured creditors. You may get nothing back and suffer a total loss of your investment amount (with a loss of 100% of investment amount).

Assuming both the deposit currency US Dollar and linked currency Renminbi are not your home currency.

Now, you take a bullish view on Renminbi, so that you expect the exchange rate of USD / CNH to decrease (CNH appreciates relative to USD).

Terms

Units

Deposit currency

USD

Linked currency

CNY

Home currency

HKD

Principal amount

USD100,000 (HKD776,000, initial exchange rate of USD / HKD7.7600)

Deposit period

1 month (30 days)

Initial exchange rate (USD / CNH)

6.2150

Annual interest rate

1.500%

USD / CNH on final exchange rate fixing date is equal to or lower than 6.2150

Final exchange rate: 6.2100

When you subscribe

You invest USD100,000

On maturity date

Received currency and amount upon maturity date USD100,125.00

Your gain upon maturity date

(USD100,000 x 1 + 1.500% (Annual interest rate) x 30/360) - USD100,000 = USD125 = HKD970

USD / CNH on final exchange rate fixing date is higher than 6.2150

Final exchange rate: 6.2400

When you subscribe

You invest USD100,000

On maturity date

Received currency and amount upon maturity date CNH622,276.88 (principal plus interest paid in CNH by exchange rate of 6.2400)

Your loss upon maturity date

[(USD100,000 x 1.500% (Annual interest rate) x 30/360) x 6.2150] / 6.2400- USD100,000 = USD276.14 = HKD2,142.86

Assuming that the Bank becomes insolvent during the tenor of this product or defaults on its obligations under this product, you can only claim as its unsecured creditors. You may get nothing back and suffer a total loss of your investment amount (with a loss of 100% of investment amount).

MXI Deposit offering documents

Extended online trading hours to 20 hours everyday. Eligible customers who successfully subscribe Capital Protected Investment (CPI) Deposit online can enjoy extra 2% p.a. interest rate for one month.Investment involves risks. Prices of foreign exchange may go up or down. Terms & Conditions apply.

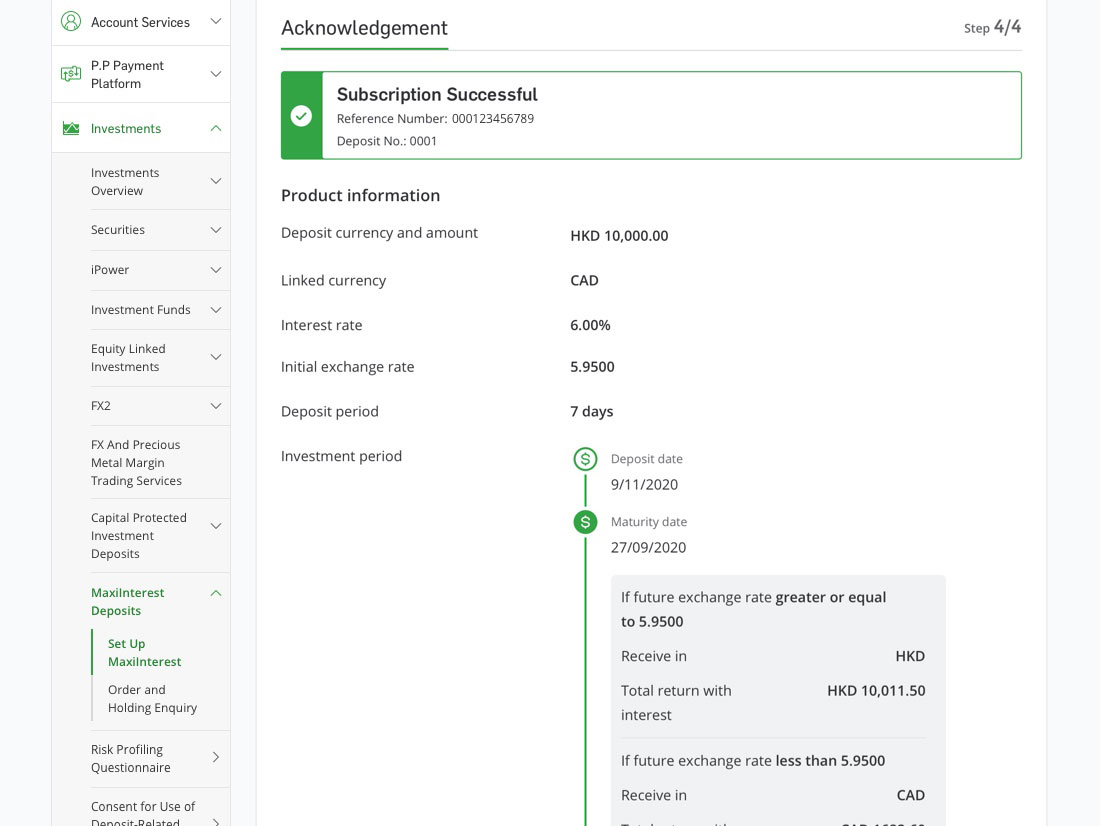

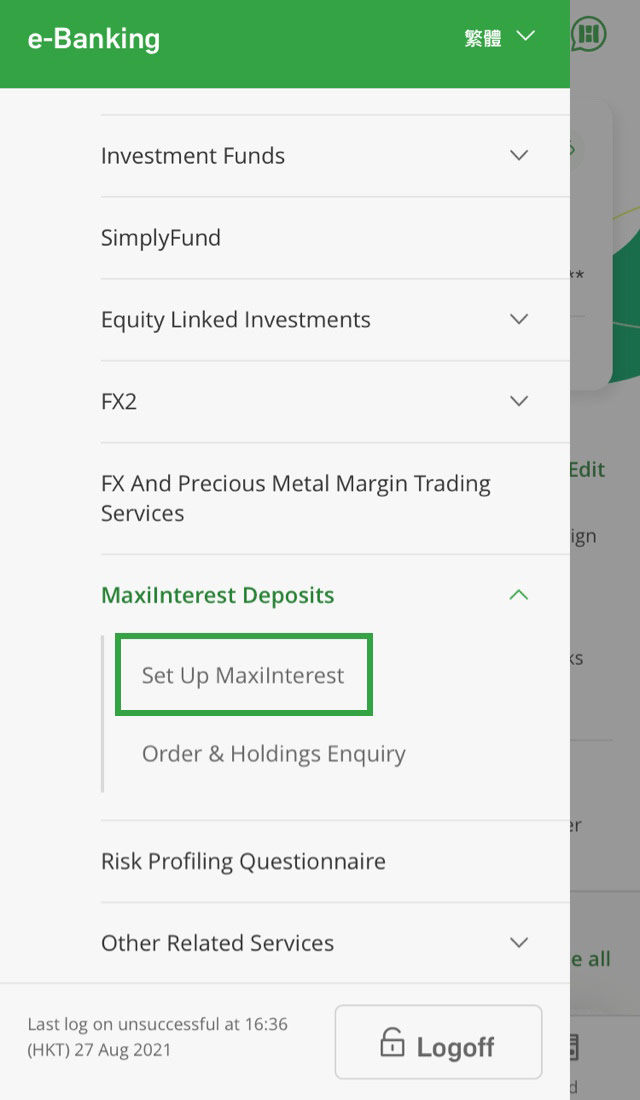

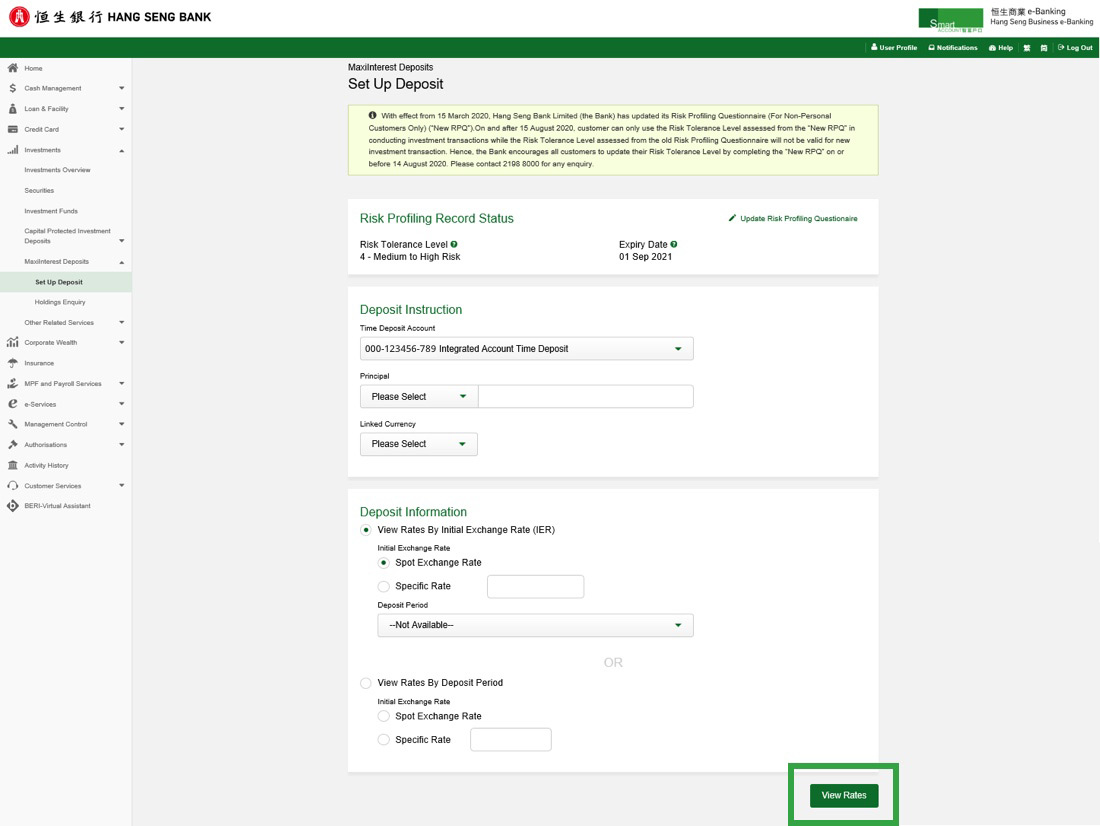

You can subscribe for a MXI deposit during the below available hours from Monday to Friday (excluding Hong Kong public holidays, half-day trading, or market disruption days).

| Ways to subscribe | Available hours |

|---|---|

| Branch | 9:00 am to 5:45 pm |

| Personal e-Banking | 9:00 am to 3:30 am of the next day |

| Business e-Banking | 9:00 am to 6:00 pm |

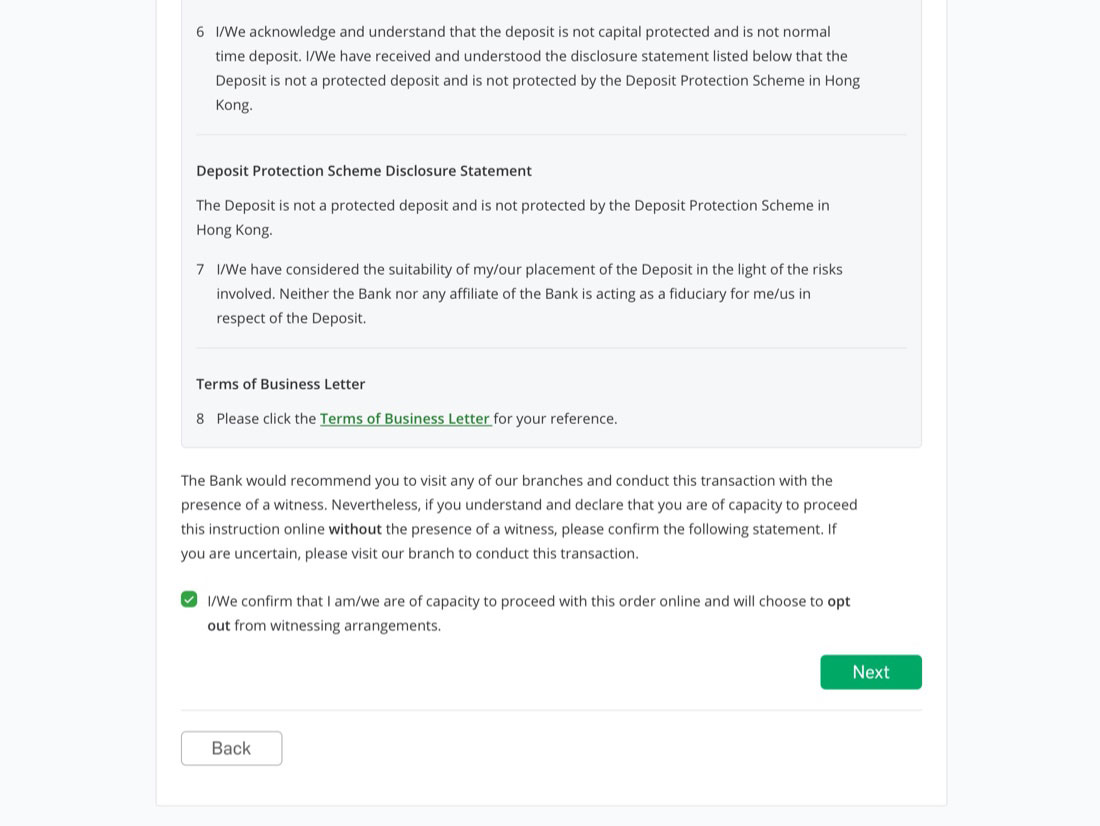

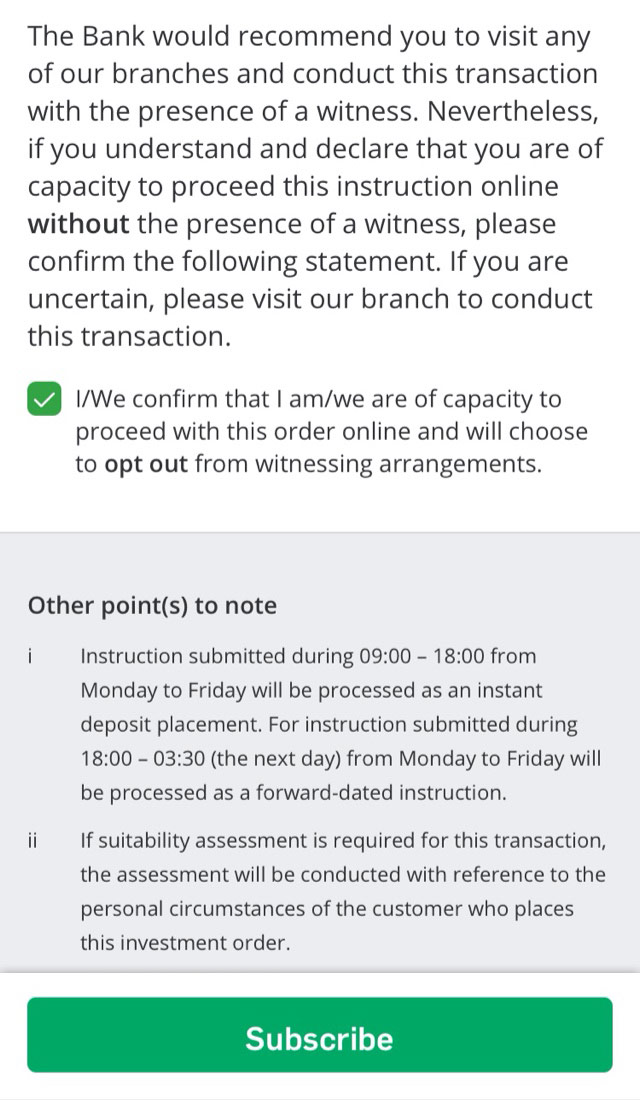

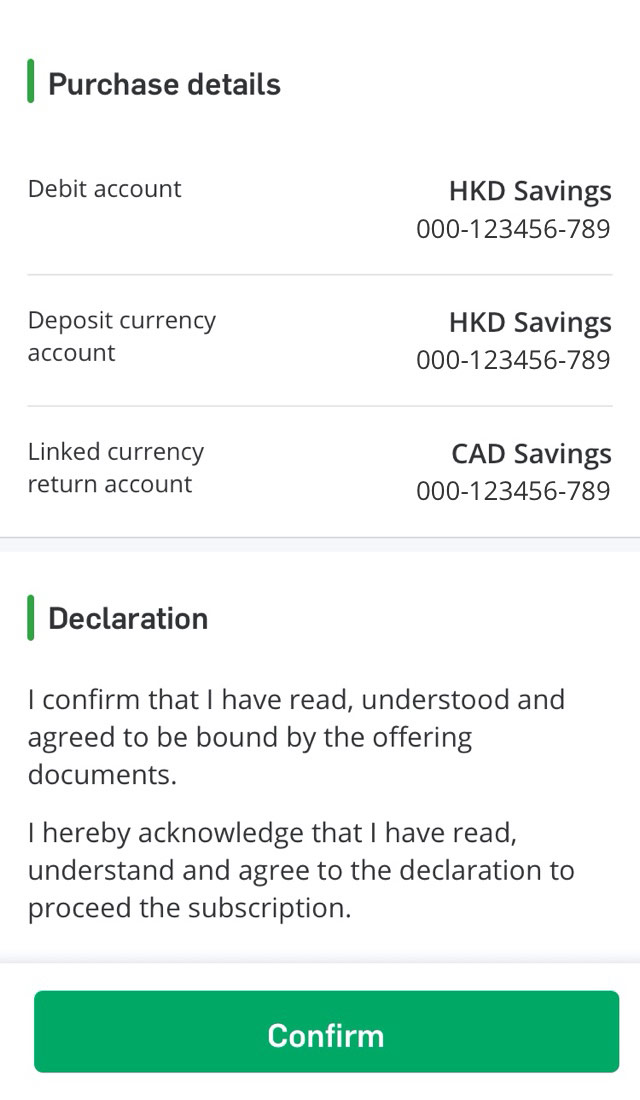

After setting up the MXI deposit, customers are not allowed to amend, cancel or terminate the MXI deposit before its maturity date.

If you've registered e-Statement / e-Advice Service for your Integrated Account, you can view and download e-Advice via Personal e-Banking or Hang Seng Mobile App. Otherwise, you'll receive paper advices.

FX hotline:

(852) 2822 8233

Personal customer:

(852) 2822 0228

Commercial customer:

(852) 2198 8000