We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Enjoy up to 6.9% p.a. 1-month time deposit rate for designated currencies exchange and earn stable interest return.

Worldwide transfer services via secured bank-to-bank networks.

Brand-new online Track My Remittance function, gives you an at-a-glance view on the progress of your outward remittances to overseas at any time.

Handling fee[1] is as low as HKD65 via Personal e-Banking or HKD190 through branch and Phone Banking.

Transfer applications can be submitted via Hang Seng Personal e-Banking, our branches or Phone Banking.

| Currency | Code |

Hang Seng Personal e-Banking[3] | Branch[3] |

|---|---|---|---|

| Australian Dollar |

AUD |

12:00 |

10:00 |

| Canadian Dollar | CAD |

18:00 |

17:00 |

| Danish Kroner | DKK |

18:00 |

16:00 |

| Euro | EUR |

18:00 |

17:00 |

| Hong Kong Dollar | HKD |

17:15 – 18:00 |

16:00 |

| Japanese Yen |

JPY[4] |

11:00 |

9:30 |

| New Zealand Dollar | NZD[5] |

11:45 |

9:45 |

| Norwegian Kroner | NOK |

18:00 |

16:00 |

| Pound Sterling | GBP |

18:00 |

17:00 |

| Renminbi | CNY[6] |

16:00 – 16:30[7] |

15:45[7] |

| Singapore Dollar | SGD |

15:25 |

13:25 |

| South African Rand | ZAR[8] |

15:00 |

13:00 |

| Swedish Kroner | SEK |

18:00 |

16:00 |

| Swiss Franc | CHF |

18:00 |

16:00 |

| Thai Baht | THB[9] |

11:00 |

10:00 |

| US Dollar | USD |

18:00 |

17:00 |

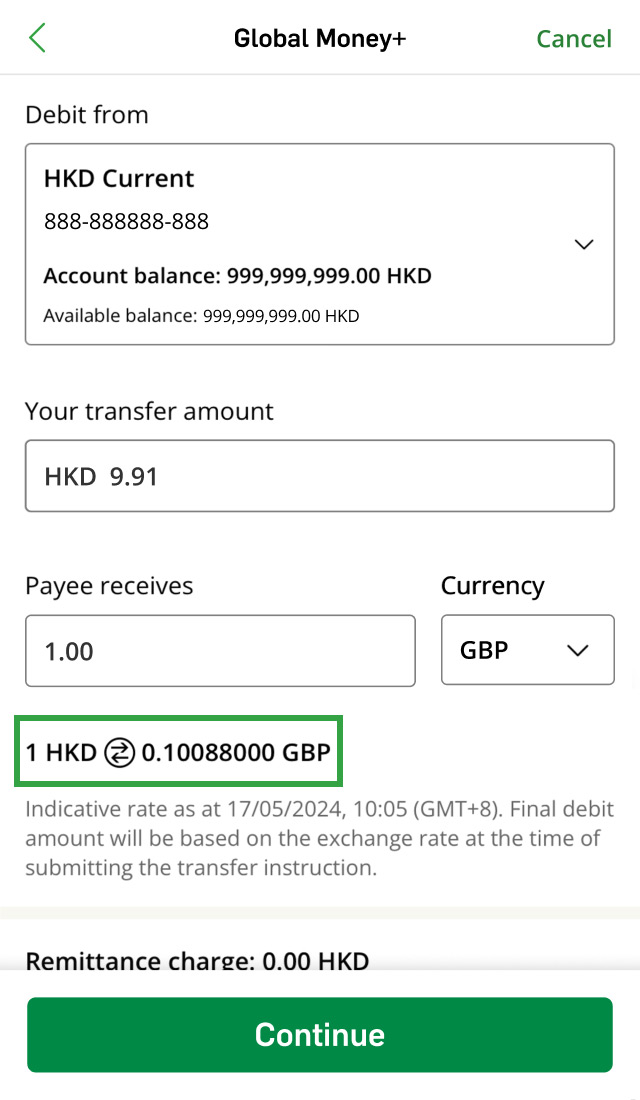

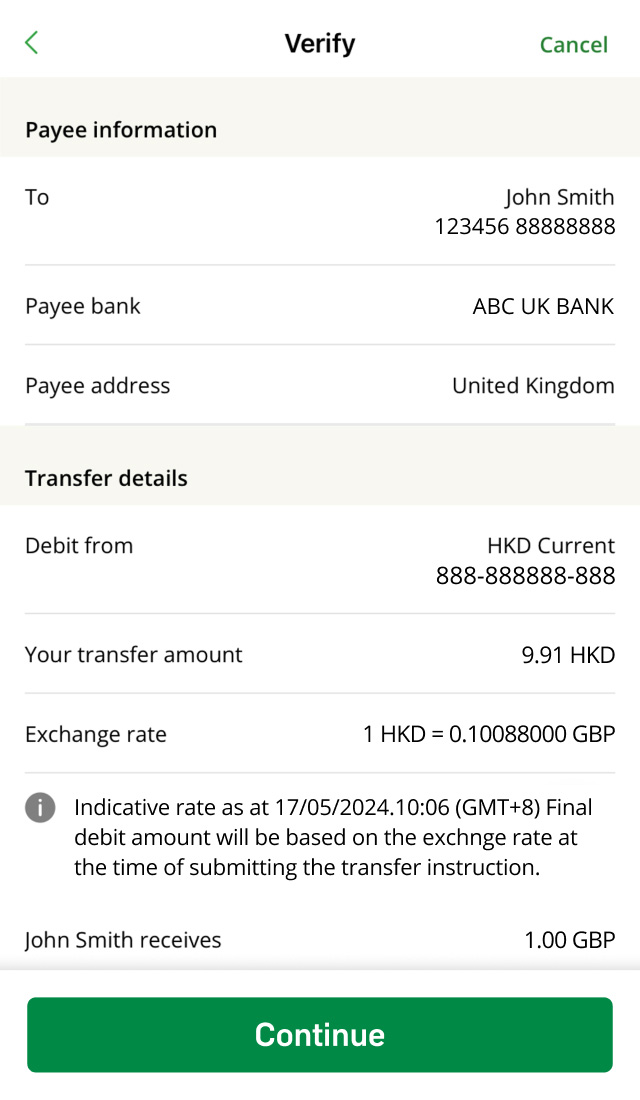

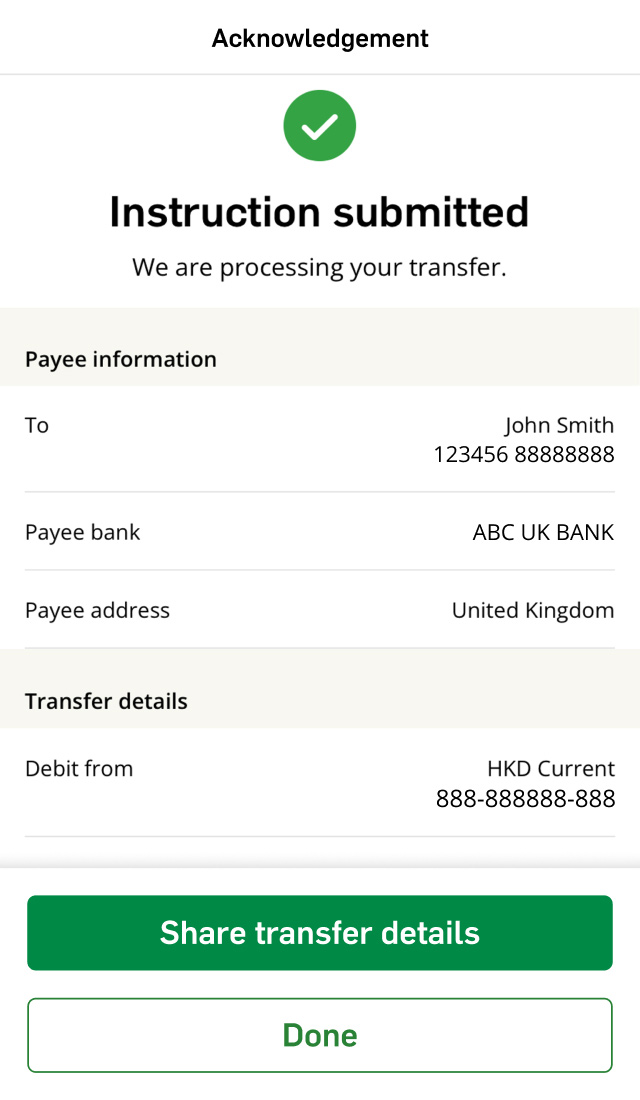

You can submit your transfer instruction online by using Hang Seng Personal e-Banking, make use of our branches or Phone Banking. We offer a preferential transfer charges if you submit the payment online.

If you would like to submit your transfer application via our branches, you may fill in our Remittances Smartform, a PDF version of transfer application, then print, sign and submit via our branches.

You can transfer money in 16 currencies via Hang Seng Personal e-Banking, our branches or Phone Banking. The bank may add or delete the currency from time to time. For full details, please visit our currency converter to view the latest foreign exchange rates.

Currency |

Code |

|---|---|

Australian Dollar |

AUD |

Canadian Dollar |

CAD |

Danish Kroner |

DKK |

Euro |

EUR |

Hong Kong Dollar |

HKD |

Japanese Yen |

JPY |

New Zealand Dollar |

NZD |

Norwegian Kroner |

NOK |

Pound Sterling |

GBP |

Renminbi |

CNY |

Singapore Dollar |

SGD |

South African Rand |

ZAR |

Swedish Kroner |

SEK |

Swiss Franc |

CHF |

Thai Baht |

THB |

US Dollar |

USD |

Application submitted via |

Daily Limit |

|---|---|

Hang Seng Personal e-Banking |

The daily maximum fund transfer limit for registered account via Hang Seng Personal e-Banking (Desktop version) or Hang Seng Personal Banking Mobile App is HKD1,500,000. The limit is shared by (i) Cross-Border Transfer, (ii) fund transfers to registered third-party Hang Seng Hong Kong Accounts, (iii) remittances and (iv) fund transfers to other Hong Kong registered bank accounts through FPS or CHATS.

You can register your Hang Seng China account under Limit / Payee Maintenance section or during the submission of the Cross-Border Transfer instruction. Registered Account instruction will be effective on next working day when submitted before 9 pm from Monday to Friday or 6 pm on Saturday. Instruction will be effective in two working days when submitted after 9 pm from Monday to Friday or 6 pm on Saturday or on Public Holiday.

If you do not register your self-named Hang Seng China account, the daily maximum fund transfer limit for non-registered account via Hang Seng Personal e-Banking (Desktop version) or Hang Seng Personal Banking mobile app is HKD400,000. The limit is shared by (i) Cross-Border Transfer, (ii) fund transfers to non-registered third-party Hang Seng Hong Kong Accounts, (iii) remittances and (iv) fund transfers to other Hong Kong non-registered bank accounts through FPS or CHATS.

For transferring Renminbi to mainland China, please refer to the questions under the part of “mainland China transfer” in FAQs below.

The mainland & overseas daily transfer limit is HKD1,500,000, and only applies to transfer payee outside Hong Kong. The transfer amount may also subject to registered payee daily transfer limit, non-registered payee daily transfer limit (please refer to the above paragraph) or small value daily transfer limit, whichever is lower. Mainland & overseas daily transfer limit is applicable to mainland and overseas transfer, FPS x PromptPay QR Payment. Please note, CNY transfers to same name account in mainland China will be subject to a daily limit of CNY80,000 based on CNY transfer regulations. For details, please refer to FAQs of Cross-Border Transfer. |

Branches |

No specific limit |

Phone Banking |

HKD100,000 for non-registered payee |

Yes, you can apply through our branches or phone banking to place a Standing Instruction to remit a designated amount of money regularly (e.g. monthly or quarterly) to a designated payee by debiting a designated account maintained with Hang Seng Bank. The set-up fee for each Standing Instruction is HKD100. Transfer charges per executed transaction are the same as those on normal applications submitted at branches or phone banking.

Different remit currency is subject to different cut-off time. Typically, it will send on the same business day if it is submitted before the cut-off time. Otherwise, it will be sent the next business day. For details, please refer to Outward Remittance & CHATS Services Cut-off Timetable.

You can submit overseas transfer instruction to our branch or phone banking on Saturdays. All instruction submitted within office hours will be processed on the same day except that:

The funds will be debited from the account prescribed by you on the processing day of the instruction which will be the same day or the following business day after you have submitted your instruction. (For details, please refer to Outward Remittance & CHATS Services Cut-off Timetable.)

The time when the payee receives the funds will depend on the processing time of the intermediary bank(s) / payee’s bank or its branches. Funds are usually transferred within 1-4 business days.

However, it may take longer for payment to countries / territories where exchange control is in place, where it is the payee bank's requirement to release funds upon contact with the payee, or if the payment has to go through a number of banks and branches.

Our Bank will send out the transfer instruction to the payee’s bank as usual, but it may not be processed by the clearing bank of the payee’s country / territory during holidays in its country / territory, subject to the operations and practices adopted by the clearing bank / correspondent bank of the payee’s country / territory.

Corresponding bank charge is not included. For more information, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

Transfer to a payee account with |

Currency |

Charge (Per transaction)(including "Handling Charge" & "Cable Charge") |

|

|---|---|---|---|

Via Hang Seng Personal e-Banking |

Via Branches, Phone Banking and Standing Instruction Footnote remark square bracket [10] |

||

Hang Seng in mainland China / Macau |

Any |

HKD65 |

HKD190 |

Another bank in mainland China / Hong Kong / Macau / Taiwan |

Any |

HKD230 |

|

Other countries / territories |

HKD / Local Currency |

HKD230 |

|

Non-Local currency |

HKD270 |

||

Each bank has its own tariff and the pricing is subject to change periodically.

If the transfer instruction has not been sent, no handling or cable charge will be payable; otherwise, HKD200 (handling charge) plus HKD100 cable charge, if applicable and foreign bank charge (if applicable) will be payable. Losses relating to changes in exchange rates may be incurred for instruction reversal of transfers involving foreign exchange.

Please refer to Part B: “Remittances and Foreign Exchange Service” > “Outward Remittances” of the Banking Services Fees and Charges for details.

You may call our Remittance Hotline at (852) 2123 1088 or approach our branches and provide the overseas transfer details as below:

The Bank's charge for each cable inquiry is HKD100 (if applicable) plus foreign bank charge (if applicable) (minimum HKD250 as handling fee per enquiry).

You can track the progress of your outward remittance from Hang Seng to other overseas banks via Track My Remittance service, while inward remittance to Hang Seng cannot be tracked.

Your overseas outward remittance instructed in all channels, including e-Banking, Branch and Phone Banking, can be tracked under Track My Remittance. No additional service fee shall be charged for Track My Remittance in additional to remittance instruction setup service fee.

Each remittance instruction shall have one Unique End-to-end Transaction Reference (UETR). It is a unique reference number shared across all banks. You can use this reference number to check your remittance status with other banks.

CNY outward remittance is processed via Cross-border Interbank Payment System (CIPS). Under related CNY remittance restriction, we are not able to provide remittance bank information on CNY remittance to banks in China.

Yes. Track My Remittance is applicable for remittance from Hang Seng Bank to other overseas banks, while remittance to Hang Seng China is not applicable.

If a remittance bank is not registered under SWIFT Global Payments Innovation (GPI) network, the processing status of that remittance bank will not be displayed under Track My Remittance.

You can remit Renminbi through your personal Renminbi account maintained with Hang Seng Bank to your personal same name Renminbi account in Mainland China if you are an individual customer (i.e., not a commercial customer). The daily limit is CNY80,000 for a Hong Kong Identity Card holder in accordance with current CNY Transfer Regulations (If the remittance is used to pay for property purchase price/mortgage repayment of the residential property in the Greater Bay Area, it is not subject to the daily maximum remittance amount limit).

Transfer to mainland China or other places outside Hong Kong for a non-Hong Kong Identity Card holder is subject to local rules and requirements of mainland China or the relevant jurisdictions. Overseas transfer may be rejected due to local regulatory requirements and rules and subject to charges applicable to returned transfers.

Purpose of payment is required for CNY remittance to Mainland China. Please refer to Purpose of Payment Category for details.

The charge is HKD65 via Hang Seng Personal e-Banking or HKD190 / HKD230 via branches, Phone Banking and Standing Instruction. Corresponding bank charge is not included.

For more information, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers regarding privileges for the Integrated Account of Prestige Private/Prestige Banking.

If Hong Kong and Macao residents purchase new and second-hand residential properties in 9 cities in the Great Bay Area: Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing, and pay for related mortgage repayment /property purchase price (including deposit, security deposit, down payment, full payment, public maintenance fund, home purchase related taxes and liquidated damages, etc.), this remittance is not subject to the daily CNY remittance limit.

Currently, this remittance service is only available at branch with no need to make appointment in advance.

SWIFT refers to Society for Worldwide Interbank Financial Telecommunication. SWIFT BIC is a Bank Identifier Code (8 or 11 alphanumeric characters) used in interbank telecommunication to ensure the transfer message can reach the correct payee bank. For example, HASEHKHHXXX represents Hang Seng Bank Limited (Hong Kong), while HASECNSHHSH represents Hang Seng Bank (China) Limited, Shanghai Branch.

Fedwire number / ABA number is an identifier (clearing number) of a domestic bank in the USA.

IBAN stands for International Bank Account Number. Some European Banks only accept IBAN for transfer processing. The first two letters represent the Country / territory code, followed by check digits, identifier codes of account holding bank / branch, and customer account number. The maximum length is 34 digits.

To register a new payee account: Please apply in person at any of our branches. To delete an existing payee account, please go to “Customer Service” > “Account Maintenance” > “Registered Account List / Limit” and then click “Delete” to remove the old registered account.

Different countries / territories have their own local clearing code for processing the transfer. Here is the information of local clearing code that we support for some countries / territories.

Payee bank country |

Clearing number code |

Input format (Omit “-“) |

|---|---|---|

Australia |

BSB number |

6 digits (e.g. 0632430 6 3 2 4 3) |

Canada |

Routing number |

9 digits (e.g. 0016000020 0 1 6 0 0 0 0 2) |

Germany |

BLZ code |

8 digits (e.g. |

United Kingdom |

Sort code |

6 digits (e.g. 4005154 0 0 5 1 5) |

United States |

ABA number |

9 digits (e.g.0210000890 2 1 0 0 0 0 8 9) |

A hardcopy advice will be printed on the next business day after the transfer reaches your account and will be mailed to you.

For Hang Seng Personal e-Banking customers, you will receive an Inward Remittance e-Advice when funds are successfully transferred to your accounts. The advice(s) will be kept for 30 days from the advice(s) delivery date. After that, the advice(s) will be automatically deleted.

Moreover, you can also set up e-Alert Service which will notify you of an inward payment of any amount or a specified amount credited to your registered account. Please note that the credit amount is the net amount after deduction of charges, if any.

You must register for the e-Alert Service via Personal e-Banking. The e-mail e-Alert service is free of charge, but the SMS e-Alert service is chargeable. Log on to Hang Seng Personal e-Banking then go to "e-Services" > "e-Alert" for details of the e-Alert Service Plan and Charges.

Due to exchange control, inward CNY transfer will happen if a Hong Kong Identity Card holder has previously sent a transfer to his / her account in mainland China from his / her CNY account in Hong Kong. In such cases, the customer will be allowed to send back a CNY amount not exceeding the original transfer amount to his / her CNY account in Hong Kong with prior approval from the relevant authorities in mainland China. Transfer from mainland China or other places outside Hong Kong for the non-Hong Kong Identity Card holder is subject to local rules and requirements of mainland China or the relevant jurisdictions.

Under normal circumstances, funds will be credited to a customer’s account on the same day if the transfer instruction from the transferring bank is received before the cut-off time on a business day (5:30 p.m., Monday through Friday; 11:00 a.m. on Saturdays; excludes public holidays)

For the funds remitted directly from a foreign bank, the bank charge is waived. For more information, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

General information: You should provide the remitter with your account information, including account holder's name, bank's name e.g., Hang Seng Bank Limited, and account number as well as Hang Seng Bank’s SWIFT code, which is HASEHKHH.

Outward Transfer from the USA: For transfer from the USA, you should also provide our CHIPS No. 010522 in addition to your account information and Hang Seng Bank’s SWIFT code.

Or you can simply download the Transfer Template and e-mail / fax to the payee.

It is vital to provide complete and accurate account information to the remitter. Otherwise, the transfer may be delayed or rejected. If Hang Seng Bank is able to identify that you are the payee of a transfer with incorrect payee details such as account number and name, we may ask you to inform the remitter to make an amendment via the correspondent bank. You can call our Remittance Hotline at (852) 2123 1088 to check the status of your transfer.

Transfer funds fee-free among your self-named accounts in Hong Kong and China.